One of President Donald Trump’s first actions back in the Oval Office is to implement tariffs on Canada, Mexico, and China. A tariff is a tax imposed on imports from another country. Tariffs will urge citizens to buy American made goods, but how will this impact inflation and the price of American made goods?

Why Tariffs?

These tariffs are being implemented because of Canada, Mexico, and China’s response to Trump’s plans for immigration control. According to the White House, Trump’s administration says they want “to hold Mexico, Canada, and China accountable to their promises of halting illegal immigration and stopping poisonous fentanyl… from flowing into our country.” Trump plans on implementing a 25% tariff on imports from Canada and Mexico, and on all imported steel and aluminum. He’s also putting a 10% tariff on China and Canadian energy resources. The administration hopes that these tariffs will provide power over these countries in order for them to tighten their borders and prevent drug dealing. However, the tariffs can also result in some major negative impacts for U.S citizens.

The Cost of Goods

Office of U.S. President Donald Trump (CC0)

The cost of goods will become more expensive, even if it is made in America. The materials necessary for production in the United States of some goods have to be imported from these countries, since America doesn’t have the resources to make them. Even though the businesses will be paying the tariff itself, they will be forced to increase the cost of their product to account for the changed charges. More specifically, goods like oil and lumber from Canada are necessary for the products and energy that Americans use everyday, along with plastic from China being a key ingredient in the clothing that every American needs.

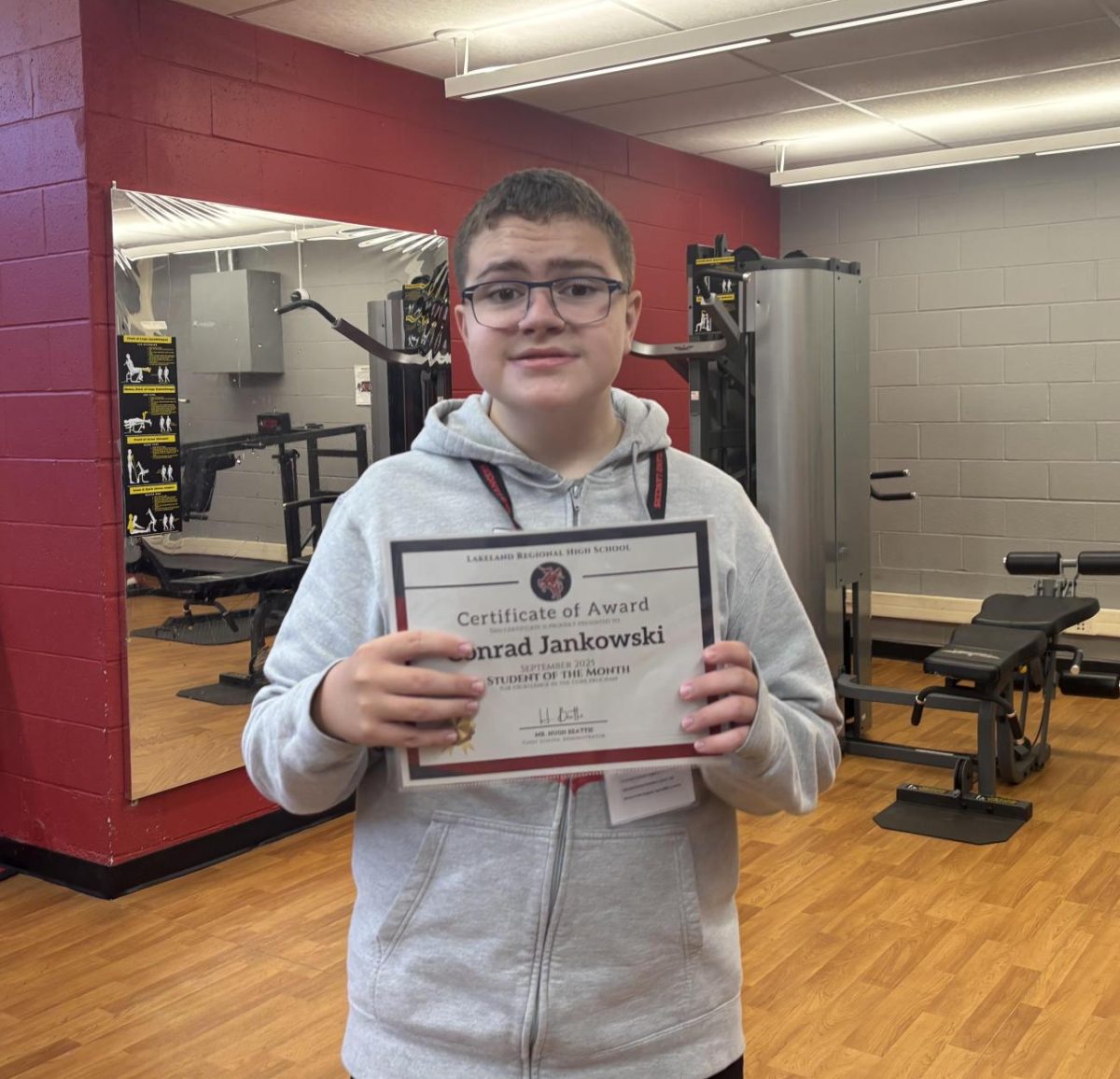

A study from Yale University shows that the new tariff policy will cost the average American household $1,000 to $1,200 each year. Did you know that the varsity letterman jacket that most high school athletes work for is actually made in Mexico? So yes, even the value of a person’s varsity letter will also become more expensive.

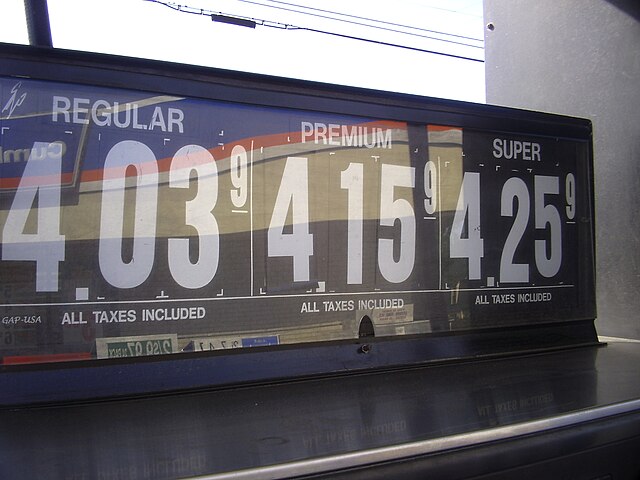

By Micov (CC BY 3.0)

One of the biggest issues amongst the American people in recent years has been the price of gas and other transportation costs. Canada has a large share in the U.S energy market, especially gasoline. Although the tariff on Canadian energy resources will only be 10%, the price of gas will cut into every American’s wallet, more than it has in recent years.

The Effect of the Response

When the tariffs were announced, Canada’s response was fast and effective. Canadian Prime Minister Justin Trudeao established a tariff on imported American goods. Trudeau urged a boycott on all American goods and took American alcohol off the shelves of liquor stores. Officials from China also established counter tariffs, but made them more specific. There will be a 15% tariff on coal and liquified natural gas products and a 10% tariff on crude oil and machinery from America. American business owners will face the effects of these counter tariffs since the sales from these countries will go down.

Although the tariffs are paused while the countries try to come up with a final chance for agreement, Trump’s administration claims that he “is using the tools at hand and taking decisive action that puts America’s safety and our national security first.” Regardless, these statistics have proven that American consumers may pay the price for Trump’s immigration plans.